Crypto Start Up (NDA)

Synopsis

#Proposition shaping, #DesignThinking, #UX, #Research, #prototyping

The service is a new crypto tracker & tax tool / app. Whilst not a unique service per-se, the intent is to get something comparable live initially and build a small user base – with a longer term view to surpass the experience others offer. It’s target market is who we classed as ‘low to mid’ experience level in terms of crypto knowledge and also tax: both are not the most straight forward to grasp for many.

Team

PO (founder)

Lead Designer UX/UI (myself)

1x Dev

+ partial UI/Branding Designer (junior/mid)

My role in this project

supporting the PO/Founder with research, prototyping, testing with users and designing how the service itself would work and be structured.

For awareness

The Problem

Crypto can be tough for many to grasp but the overall trajectory is onboarding mass market, over time. Tax laws across each country differ today and are never easy to navigate (for traditional financial assets, let alone crypto).

How do crypto users and investors track and manage their tax? The beauty of on-chain, is the potential to hook in (via API’s) to automatically pull in data for calculations, cross checking and validation – doing most, if not all the heavy lifting for you.

In practice, the automation and API’s are not great today in terms of seamless and painless experiences – manual intervention and checks are typically necessary, even with the competitor services in the market.

Exploring Proposition

Some highlights from concept exploration & early research

RESEARCH

Competition

Reviewing what’s out there already was one of the first tasks.

Customer views

Some remote guerrilla research, sourced online as well as a handful of our own connections with more crypto related experience, helped us frame how our prospective customers think and feel about their crypto trades/investments and how they consider any tax implications.

Customer Behaviour

Customers trading actions are not ‘neat’ and can be impulsive and/or under time pressure.

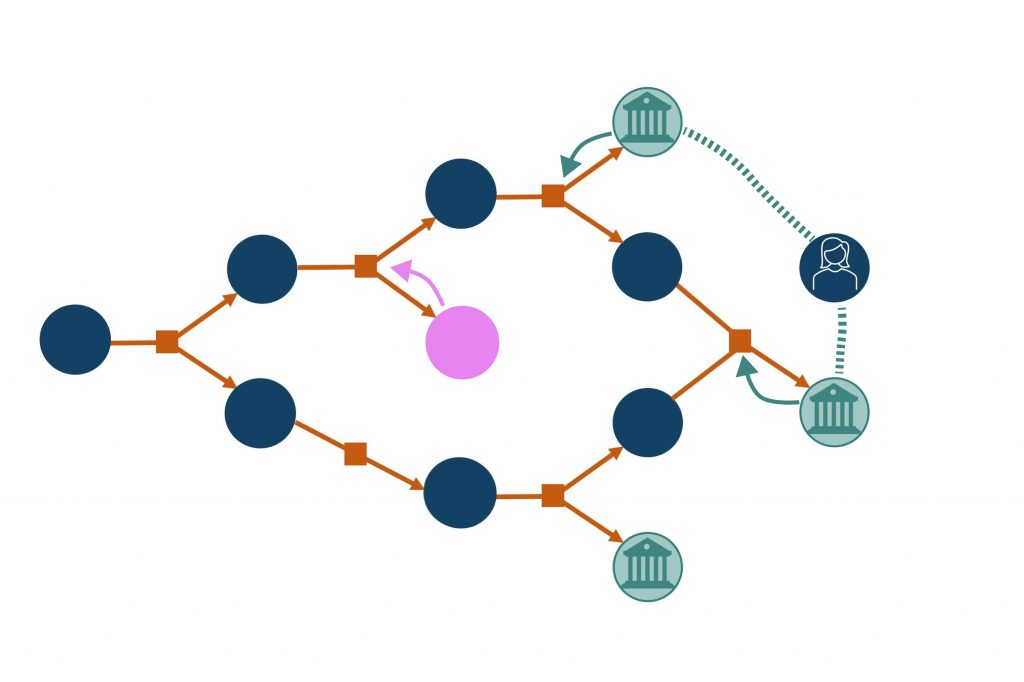

Users currency and crypto can be bought, moved around many times to new wallet(s), sold, bought back again shortly afterwards, wait out the market until a better price arrives. Most are not thinking about whether these decisions and moves are going to make their tax return more complex (and nor should they).

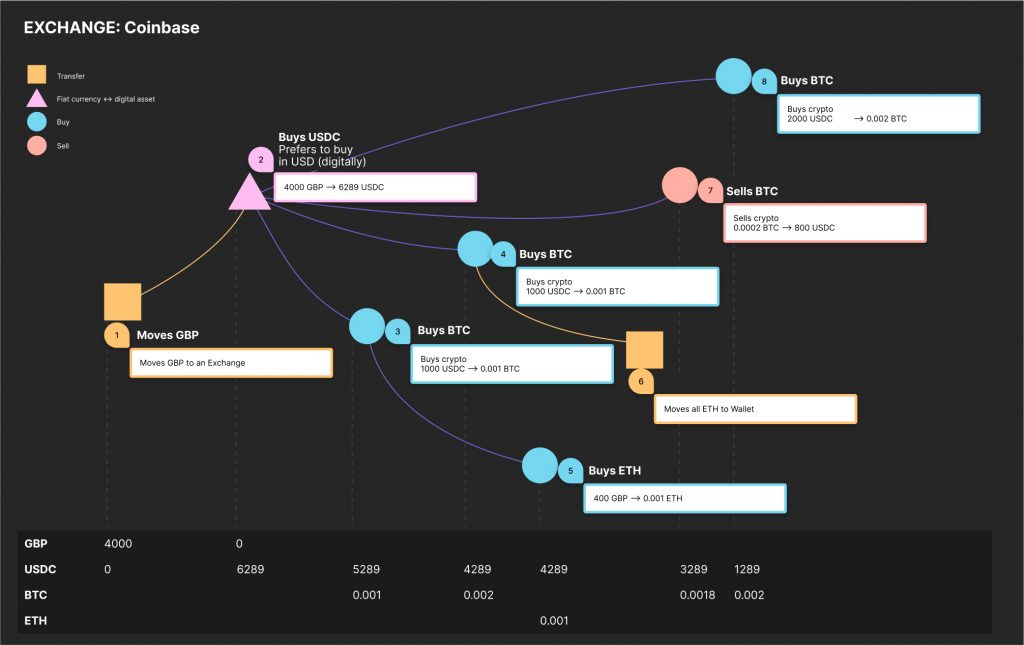

A typical example: Coinbase

Multiply this by…

Once you factor in a customers actions across multiple exchanges, wallets, staking platforms, blockchain protocols – the aggregated picture can become a sprawling beast to decipher.

Key Takeaways for a competitive tax service: The mission for this service has to be making the process as automated & painless as possible; the dream for many of the users is a 'sync and download' tax return / report. Best interpreted data wins: the crux to making this service a seamless experience is avoiding the need for manual correction/intervention in the first place. - API connection and format/interpretation is paramount - Correct & accurate categorisation of each part of a transaction chain The Full picture or else it becomes worthless: services that cover the widest range of API integrations are likely to have an advantage - a partially complete tax report is no good. If there are errors...this must feel as painless as possible for customers, avoiding manually trawling back through their whole transaction chains. Downloadable tax data and/or forms, ready to go Should Cover capital gains and Income tax (rewards/airdrops/staking) Realtime Prompts / notifications to help users be prepared in advance of tax deadlines and whenever they're closing in on cap gain limits.

About the Design

Crypto portfolio tracker & tax management

IA&UX

Subject matter acclimatising

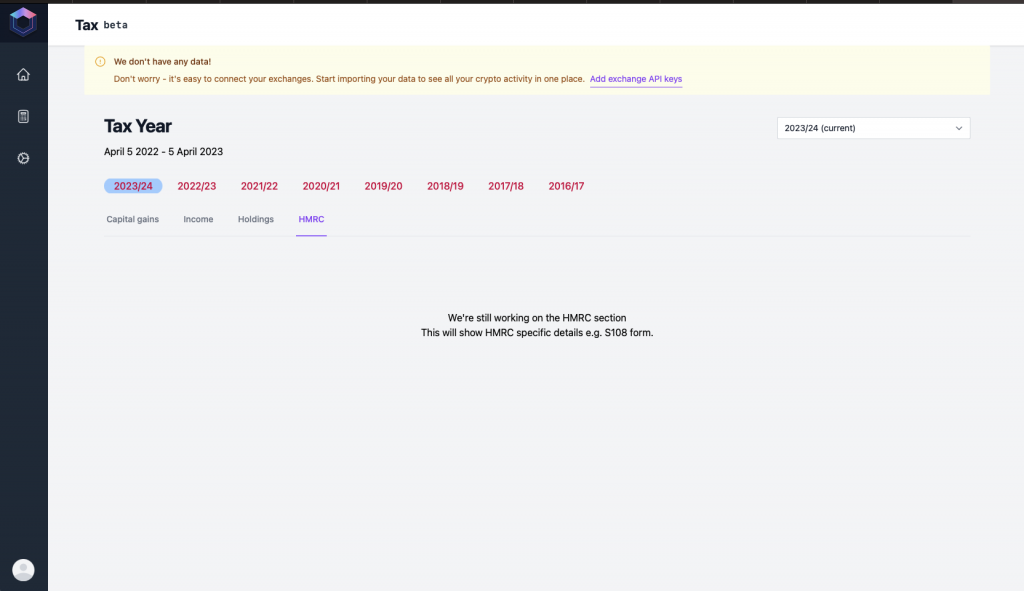

Part of my process needed to be brushing up on tax rules (so far, still evolving) in the UK.

In the UK, it’s predominately about capital gains – calculating profit and loss within the tax year.

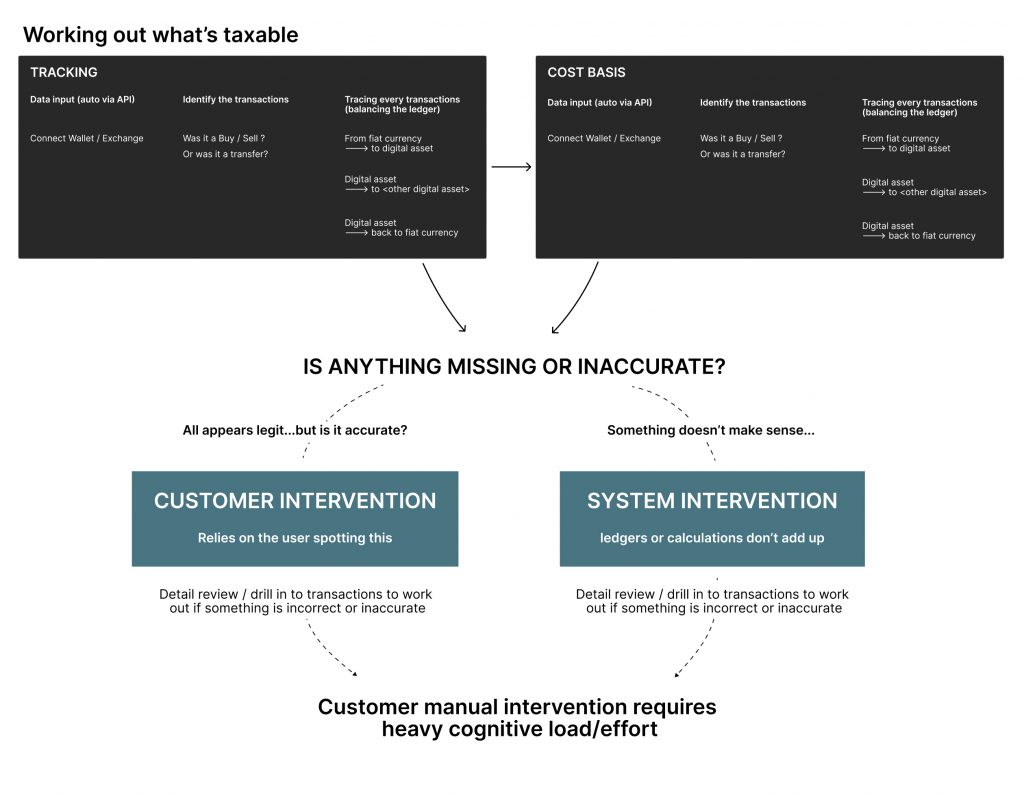

Ultimately to be able to generate a tax return, the system needs to interpret all individual transaction data touch points, in order to determine the ‘cost basis’ of the coin in question. To do that, the system must be able to fully trace back to source (or as far back as the data allows)…otherwise mis-categorisation occurs – if a system doesn’t have the full picture, it doesn’t for example, this transaction is

What are the array of possibilities that each transaction could be?

This is a lot for the system to handle and ensure accuracy and minimal user amends/input.

| Trading | Staking & Liquidity pools | Income | Loans | Businesses | Friends & Family | Transfers |

|---|---|---|---|---|---|---|

| Coin Buy | Staking Deposit | Free Airdrop | Lend Deposit | Receive | Receive | Bridging (between protocols) |

| Coin Sell | Add Liquidity | Employee Income | Lend Swap | Payment | Payment | Wallet Transfer |

| Coin Swap / Exchange | Staking Swap | Rewards Income | Reclaim Loan | Donation | Gift | |

| NFT Swap | Claim Rewards | Mining Income | Reclaim Swap | |||

| NFT Buy / Mint | Unstaking Withdraw | Borrow | ||||

| NFT Sell / Burn | Remove Liquidity | Repay | ||||

| Unstaking Swap |

How do we determine what’s taxable?

IA – high level

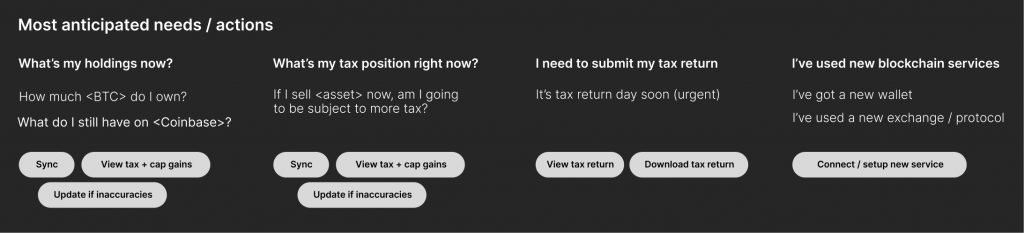

From all our research, it was fairly clear how this is likely best structured…

Keeping both areas separate mirrors user’s existing mental models & should help avoid confusion with clear distinction.

Beyond this, there were already common user needs identified, with probable ‘next actions’ – all of which we wanted to explore further and test via concept prototyping.

Validating assumptions

From this point I was able to create a high level IA map and ‘wireflows’, a selection of key screen wireframes + some higher fidelity concept samples for exploration with the PO and prototyping for concept/user tests: this was to sense check our main assumptions affecting the structure and features of the service) and shine a light on any blind spots/unknowns.

Defining scope

Given this service lives or dies on it’s accuracy and how much user intervention is needed – realistically a day 1 MVP beta release has to exclude significant parts of the crypto activity (e.g. staking)

- Targeting crypto Hodlers & basic/mid level traders

- Excluding functionality for stake pools (initially)

- Tax report: Cap gains/losses & basic report

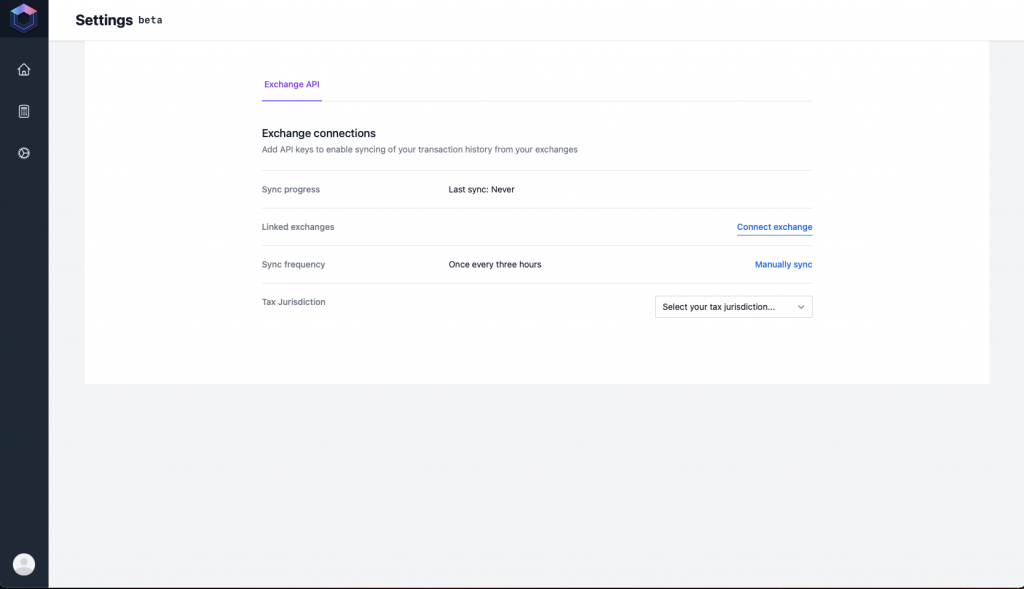

- API integration: start out with 3 main exchanges

- Option to upload manually (all providers have this)

- Tiered pricing: keep simple for launch with 1 option – introduce more as service matures

- Prioritise recognising and categorising transactions accurately

- Manual process always needed too for edge cases

Our #1 UX Principle

Whilst limited in what I can share and show, I can talk a little about the approach and ambition I helped set…

Customers need not venture ‘under the hood’

Wherever possible, the experience should match / mirror user’s mental model & expectation

…But it’s all there if/when needed

How this translates to our UX

Mirroring customer mental models

We’ll automatically do the hard grouping, categorisation and matching and roll up into the ‘actions’ the user took in their eyes

To users it wasn’t about a transfers and conversion from GBP to USDC and transfers out of the exchange to their custody wallet – they bought 0.3 BTC

The goal of our service is to mirror that as much as possible with minimal need to venture under the hood.

UI

Limited due to NDA

Whilst much of this is under NDA, I’ve included a mock up of the marketing/landing screen and some empty state logged in screens, for day 1 release – (I’ve de-badged all screens).

Desktop Screens

The Impact

Proposition shaped:

Time spent on concept & research up front, pays off

This was a proposition shaping exploration and given we started with a very loose set of ideas and little structure, I’ve helped the PO directly in guiding through user-centred research and design thinking practices to give shape and direction to this proposition.

The research done was solid and I’ve high confidence that everything we needed was considered.

Focussing on the fundamentals

The crux of this business and service is absolutely about the Data accuracy and automatic categorisation and matching – without this, we are not going to compete and certainly not come out on top.

Mapping to existing mental models

Working up from how customers think and see their actions in crypto, and shaping everything around this – will make sure we have the flexibility within the backend systems, DBs and APIs to be able to manoeuvre the data and present it in a way that matches our customers ‘mental model’: we believe this is what will make the service intuitive and a pleasure to use.